Goldman: In a moderate recession, our model implies 2023 EPS would fall by 11% to $200 (vs. current consensus of $250).

Assuming consensus EPS estimates move halfway (to $225) by year-end, a 14x P/E would bring the S&P 500 to 3150. pic.twitter.com/MI3Gn66oKV

— Mike Zaccardi, CFA, CMT (@MikeZaccardi) July 11, 2022

Recession Risk Pricing: from a quick glance at the movement of the stockmarket relative to the path of the PMI, you could argue that the S&P500 is already pricing in the risk of a recession to a certain degree… pic.twitter.com/pvmr9M4QbV

— Topdown Charts (@topdowncharts) July 10, 2022

Scheduled Economic Releases for Week of July 11, 2022 pic.twitter.com/D2oT5SlQSA

— *Walter Bloomberg (@DeItaone) July 9, 2022

I wonder how much cash corporations have right now. It was over $2T earlier this year. Have to factor that into your S&P 500 P/E ratio too pic.twitter.com/awqEVRYFg1

— Mike Zaccardi, CFA, CMT (@MikeZaccardi) July 9, 2022

Final heat map of the S&P 500's performance from this past week pic.twitter.com/vUxRnPXc5K

— KING OF SCUTTLEBUTT (@ritvikbhanot1) July 10, 2022

1/ Since 1934, stocks, especially small & Large "value", produced positive forward 96 month returns starting from July of a "Mid-term" Presidential term. When a greater than minus -10% decline occurred in the "1st half", higher than avg 96 month returns resulted (purple periods) pic.twitter.com/LwgtTbdorH

— Mark Map (@MarkMap4) July 8, 2022

MA breadth charts updated thru yesterday’s close (Consumer Staples & Utilities take top spots from Energy) pic.twitter.com/4WU794K97W

— Liz Ann Sonders (@LizAnnSonders) July 7, 2022

This is where the distinction between recession bear markets and non-recession bear markets comes in. The table below lists all bear markets since 1871. The median recession bear produces a drawdown of 35%, while the median non-recession bear produces a 22% decline. /3 pic.twitter.com/DojYMMEzPA

— Jurrien Timmer (@TimmerFidelity) July 6, 2022

More companies in the S&P 500 are seeing their estimates go down than up. Rarely does the pendulum stop at the mid-point, so chances seem good that more downgrades are coming. 🧵 pic.twitter.com/3zVYBGYNLC

— Jurrien Timmer (@TimmerFidelity) July 6, 2022

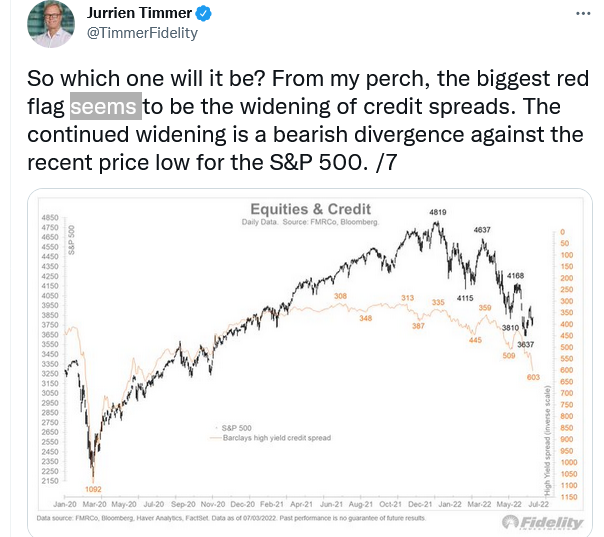

Spreads are still at reasonable levels. The current high yield OAS of 578 bps is well below the 2020 wides of 1013 bps, or even the 2016 wides of 820 bps. Still, I am always looking for inter-market confirmations at inflection points, and this one is a glaringly absent. /END pic.twitter.com/2ZyHLk8xTJ

— Jurrien Timmer (@TimmerFidelity) July 6, 2022

Investor Equity Allocation Still High – 65%, More Room To Downside – AAII survey (even with bearish sentiment) not at Mar 2020 lows, note lows near 40% in '09 and '01 crashes. h/t @LanceRoberts @spotgamma @jam_croissant @AnnTrades @johnauthers #trading #ES_F #SPY #OptionsTrading pic.twitter.com/1yycxicWct

— Patrick Hill (@PatrickHill1677) July 7, 2022

Profitability will remain a key source of alpha until we see a rebound in leading economic indicators… in late 2023. Don't get caught up in peak-inflation junk rallies in companies that do not make $$. #macro pic.twitter.com/Cs2fu5H5dp

— Kantro (@MichaelKantro) July 6, 2022

Free cash flow yield for S&P 500 Energy sector is substantially higher than that for S&P 500 Tech, reversing what was a more than decade-long trend in favor of latter pic.twitter.com/LEKVpaxGGt

— Liz Ann Sonders (@LizAnnSonders) July 6, 2022

PROFIT MARGINS … We're going to see a cost creep and revenue slowdown at the same time .. should hit margins rather sharply. #macro

Chart is ISM New Orders Advanced 6m with SPX PM (TTM). pic.twitter.com/BTgeT4SLVz

— Kantro (@MichaelKantro) July 6, 2022

Want to pick the bottom? Good luck with that. Want to know when it’s “safe to get back in the pool?” Track the 100-day average of the Nasdaq High/Low Ratio for a cross above 0.29. (HINT: Patience is required)#sentimentrader pic.twitter.com/2mhUDgZu0T

— Jay Kaeppel (@jaykaeppel) July 6, 2022

Bear market ? Yes

How are returns after ?

👉evidence overwhelmingly points to great market returns over the next 1, 3 and 5 years … whether or not we have a recession ! #equities #stocks $SPY pic.twitter.com/gt3Dgil3qA— Maverick Equity Research 🇺🇦✌️🇺🇦 (@MaverickBogdan) July 6, 2022

Looking REAlY dicey in the Value vs. Growth trade.

Lower-highs and lower-lows. Textbook downtrend! $SPY $QQQ $SPVU pic.twitter.com/oRSm3dTBCq

— Seth Golden (@SethCL) July 5, 2022

An epic recovery in S&P 500 Energy sector’s forward operating margin throughout pandemic … back to levels not seen in more than a decade pic.twitter.com/ka8isZMcZW

— Liz Ann Sonders (@LizAnnSonders) July 6, 2022