S&P 500 multiple contraction.. 20% this year pic.twitter.com/RIjesBZk4K

— Mike Zaccardi, CFA, CMT (@MikeZaccardi) June 4, 2022

Heat map of the S&P 500's performance so far in 2022 pic.twitter.com/0jWJ70KECj

— Stock Market News (@StockMKTNewz) June 4, 2022

S&P 500 is in the red, eight out of the last 10 weeks 👇🏼 pic.twitter.com/lniqk9tLRY

— Sonali Basak (@sonalibasak) June 3, 2022

If you think the market is volatile, it's because it is

The 30-days realized volatility of the S&P500 hit 33% (annualized) last week, which ranks as 5% percentile in a 100-years historical dataset

The average realized 30d vol (annualized) is 16%

Highest ever?

Nov 1929 at 98% pic.twitter.com/fb2mzDbyhR— Alf (@MacroAlf) June 1, 2022

S&P500 YTD returns by sector, ranked best to worst.

1) Basically one game in town: Energy.

2) ''Stuff you need'' > Discretionary Spending.

3) Stuff that doesn't produce cash flows now = killed. pic.twitter.com/evQjJUNmEA— Alf (@MacroAlf) June 1, 2022

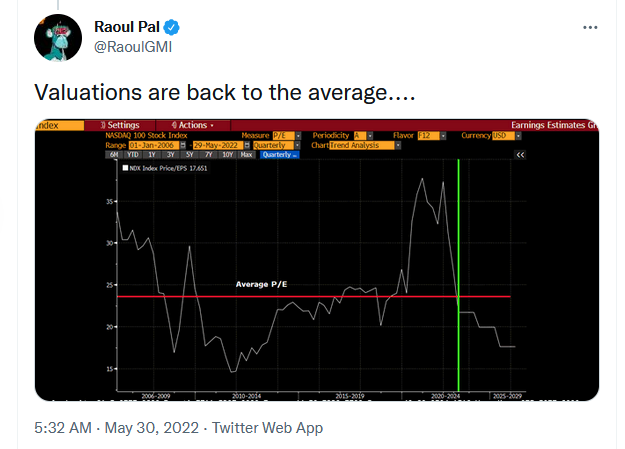

Just writing Global Macro Investor over the weekend and as ever, I like to share a few insights.

The narrative on Twitter is that tech is dead. The reality is that the Nasdaq has just reverted back to trend – 150 week moving average 1/ pic.twitter.com/JpEi0754Si

— Raoul Pal (@RaoulGMI) May 30, 2022