A benchmark U.S. yield curve is the most inverted since 2000. U.S. 2-year Treasuries are yielding the most versus 10-year notes since that year, typically a signal of recession in the following 12-18 months. pic.twitter.com/WDeCs386Jn

— Lisa Abramowicz (@lisaabramowicz1) July 26, 2022

Forget mild downturn, the German Ifo expectations index is pointing to a recession on par with the global financial crisis pic.twitter.com/u2mWEyudjE

— MacroMarketsDaily (@macro_daily) July 25, 2022

Cash levels highest since 2001 pic.twitter.com/pUx6Y1OKqz

— Cheddar Flow (@CheddarFlow) July 24, 2022

While everyone's worried about the next CPI print, base metals are SHOUTING deflation, with most of them 30-60% off of their highs

Incidentally, base metals are the commodity category with the closest relationship to the REAL growth cycle pic.twitter.com/FwPWDrxusp

— Mike Singleton, CFA (@InvictusMacro) July 25, 2022

Last week’s sub-50 services PMI “shocker” sealed the deal on recession for most. ECRI clients saw this sector-specific insight months ago – and it’s not over yet.

“You skate to where the puck is going, not where it is.” pic.twitter.com/A5c5lxxdUJ

— Lakshman Achuthan (@businesscycle) July 25, 2022

Demand destruction happening across the globe

Central banks are yet to understand this

H/t @MichaelAArouet and @FT pic.twitter.com/mheyzKo46h

— AndreasStenoLarsen (@AndreasSteno) July 25, 2022

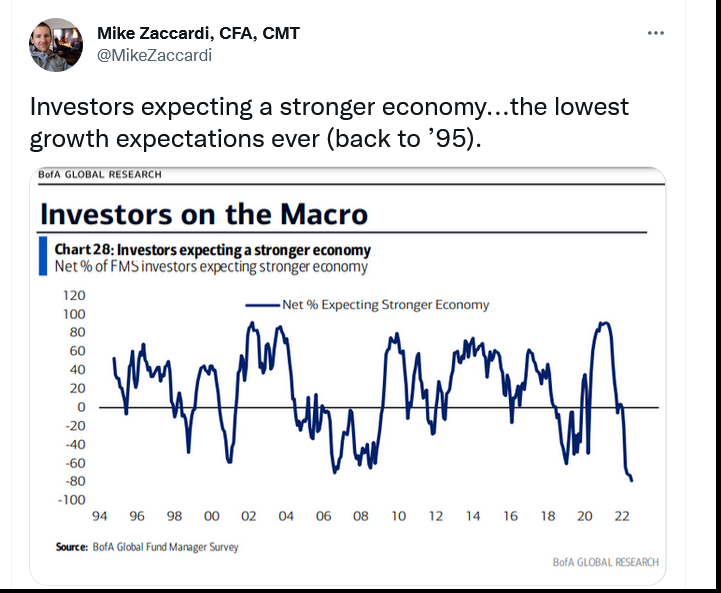

BofA's Fund Manager Survey indicates more risk-off positioning now than in the midst of the global financial crisis. Is inflation scarier than what happened in 2008? No right or wrong answer, but this would suggest it is. pic.twitter.com/rqOMA3s2J2

— Liz Young (@LizYoungStrat) July 19, 2022

S&P 500 dividend yield is at 1.7%, well below the 10-yr Treasury's yield of 2.97%. Spreads of this magnitude (-1.27%) are relatively rare. Looks like TINA has left the chat. pic.twitter.com/fhLVJcrDLv

— Liz Young (@LizYoungStrat) July 18, 2022