It’s a bad time to buy “stuff” … a record bad time. #macro pic.twitter.com/tpJsOE9F3v

— Kantro (@MichaelKantro) June 26, 2022

WTI FUTURES CURVE CAME DOWN $10 ACROSS ALL POINTS IN ONE WEEK pic.twitter.com/ivzS228ZHx

— Mike M. Mustafoglu (@TransEnergy) June 26, 2022

Let me repear, "inflation" is largely a jammed supply chain problem, largely from capacity reduction in 2020. The CRB index is BELOW where it was in 2005!

Add to it an asset price inflation from low interest rates driving a speculative demand for real estate linked goods. pic.twitter.com/odp8ou3fQP

— Nassim Nicholas Taleb (@nntaleb) June 24, 2022

This chart is an excellent illustration why Australia has a much greater problem with a potential housing crash than even Canada, almost 2/3 of all bank lending is for housing.

This compares with just ~30% in the U.S and ~40% in Canada.

Chart: @ElysseMorgan pic.twitter.com/dDJtRhoWtj

— Avid Commentator 🇦🇺 (@AvidCommentator) June 24, 2022

Immediately after June 8th, TTF increased +50% while Henry Hub is now down -20% due to Freeport #natgas $UNG pic.twitter.com/RYV9mGlTUV

— Mike Zaccardi, CFA, CMT (@MikeZaccardi) June 24, 2022

Corn, Wheat, and Soybeans are all down over 20% from their highs. Great to see, hopefully will continue. pic.twitter.com/sZhJ0fzr6k

— Charlie Bilello (@charliebilello) June 24, 2022

New orders -ve yesterday along with output. Things move at a much faster pace than historical growth cycles.

As @jvisser_weiss say, speed chess. pic.twitter.com/ItjwbE1C5a

— Teddy Vallee (@TeddyVallee) June 24, 2022

DIESEL DEMAND set to drop as economies enter recession: https://t.co/4ghf998A9L pic.twitter.com/VcaXyogarV

— John Kemp (@JKempEnergy) June 23, 2022

Housing bubble pt.2 pic.twitter.com/eZp9zC8Ug7

— MacroNick (@NicolaLampis) June 24, 2022

#Shanghai warehouse stocks (weekly update):#Copper +1,916t#Aluminum -27,584t#Zinc -21,559t#Nickel -543t#Tin -296t#Lead -11,417t#Rubber +298t https://t.co/GEAze7C7rR

— CN Wire (@Sino_Market) June 24, 2022

S&P Global PMI survey indicates factory production "fell to a degree only exceeded twice in the 15-year history of the survey, at the height of the initial pandemic lockdowns in 2020…and the global financial crisis in 2008." Look out below. pic.twitter.com/ys06VvN7My

— Liz Young (@LizYoungStrat) June 23, 2022

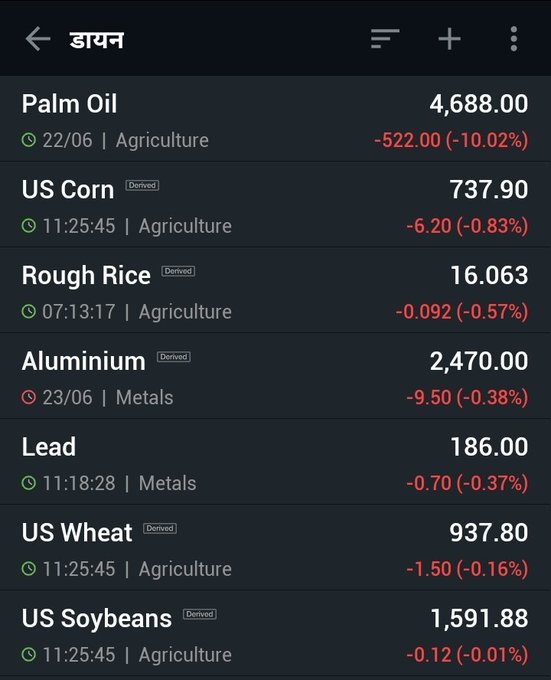

Commodities Are Falling Sharply !

In % Terms pic.twitter.com/9iYAO6GrOs

— Prashant Nair (@_prashantnair) June 24, 2022

BLOOMBERG: Oil’s Down But It’s Far From Out – good recap of what I have been saying in the last few days 👇 pic.twitter.com/tUNrKxu5Jp

— Gianluca (@MenthorQpro) June 24, 2022

The signs are just everywhere 👇 https://t.co/sddpNaZtDs

— Gianluca (@MenthorQpro) June 24, 2022

Is this a writing on the wall for consumer prices (CPI) in #Germany? German Producer Price #Inflation (PPI) rose by 33.6% in May, more than ever before. pic.twitter.com/v98FlgNG3n

— Holger Zschaepitz (@Schuldensuehner) June 20, 2022

#Inflation pressure keeps rising in #Germany. German PPI jumped by 33.6% in May YoY, the highest increase ever since the start of the statistic in 1949. Electricity prices rose by 90.4% YoY. Especially high were the price increases of fertilisers & nitrogen compounds (+110.9 %). pic.twitter.com/hvWtTOgjK5

— Holger Zschaepitz (@Schuldensuehner) June 20, 2022

Good chart, so we all get on the same page on why gasoline prices has been going up 👇 pic.twitter.com/Danwm4uFzx

— Gianluca (@MenthorQpro) June 20, 2022

If copper is the barometer of economic growth then there is nothing else to add 👇 pic.twitter.com/usrdRncIFW

— Gianluca (@MenthorQpro) June 21, 2022

📌 Flows

Capitulation has been in credit, but not in equities. Should investors expect more pain for equities?

👉 https://t.co/JKtv1wBK8oh/t @BofAML #markets #highyield #debt #credit #stocks #stockmarket#equities $spx #flows #corporatebonds #emergingmarkets #bondmarkets pic.twitter.com/oj2VV4TUNh

— ISABELNET (@ISABELNET_SA) June 21, 2022

Morgan Stanley, Goldman strategists see more stock losses. Stocks to drop 15-20% more to reflect economic contraction, MS says. Goldman’s Oppenheimer says equities reflecting mild recession.

https://t.co/IR6063noDL pic.twitter.com/Bj9fIQ6Q7L— Holger Zschaepitz (@Schuldensuehner) June 21, 2022