- Weekly chart for $USD the U.S. Dollar, end of week, 17 JUN 22

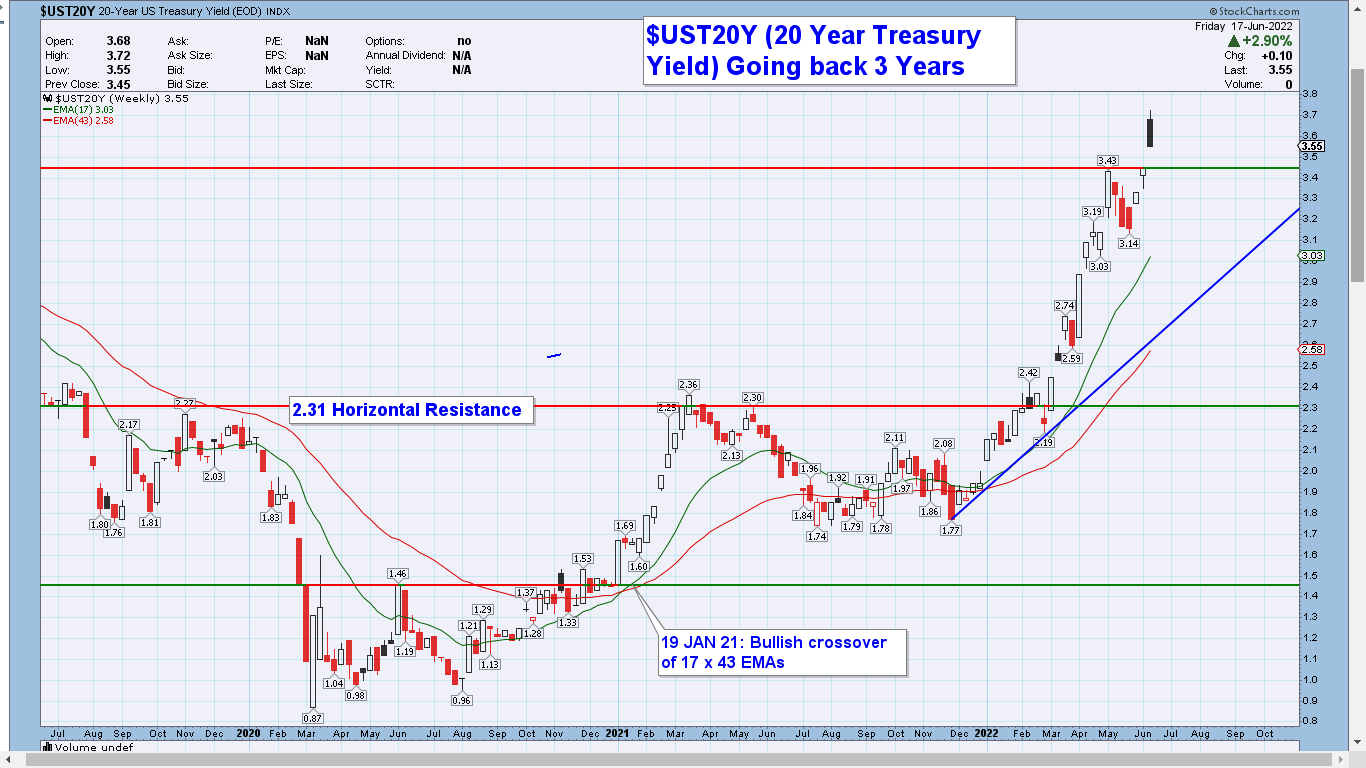

2. Weekly chart for $UST20Y, the 20 Year Treasury Yield, end of week, 17 JUN 22

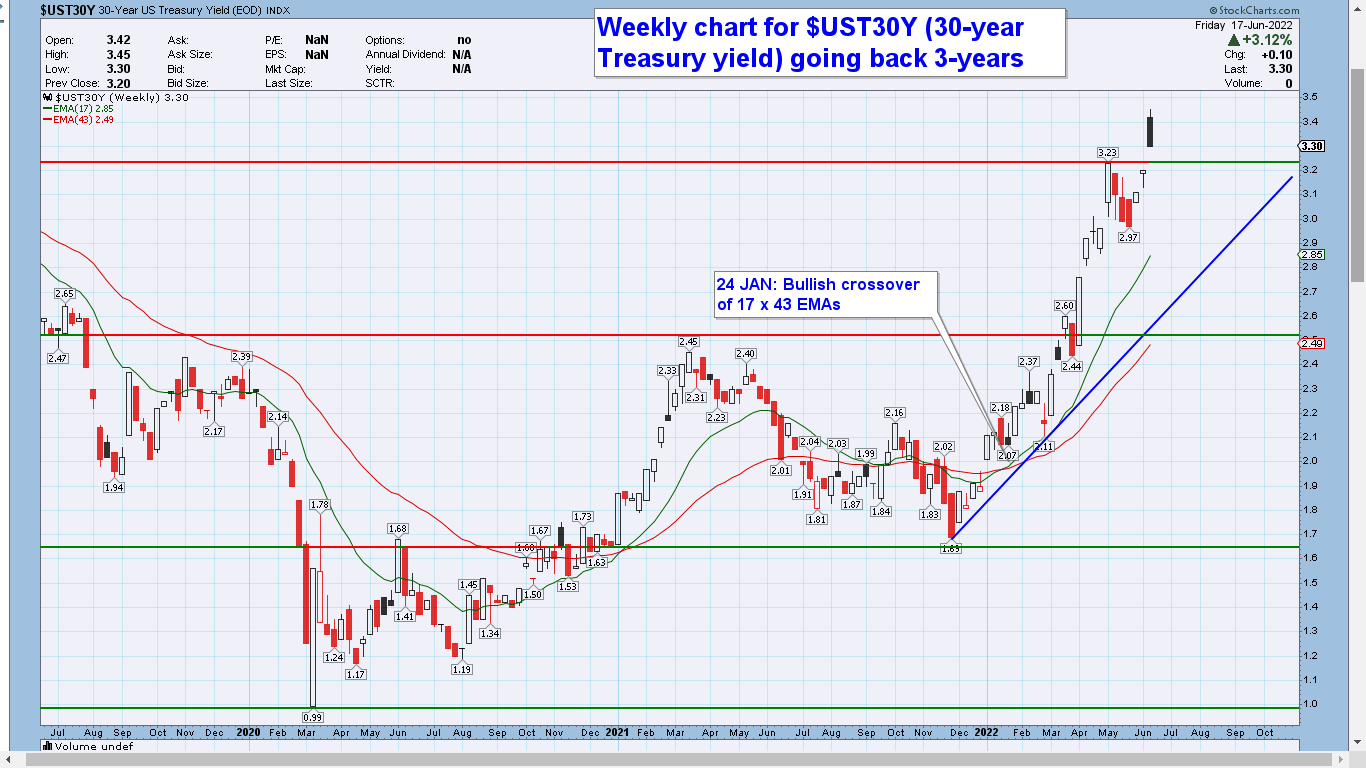

3. Weekly chart for $UST30Y the 30 Year Treasury Yield, end of week, 17 JUN 22

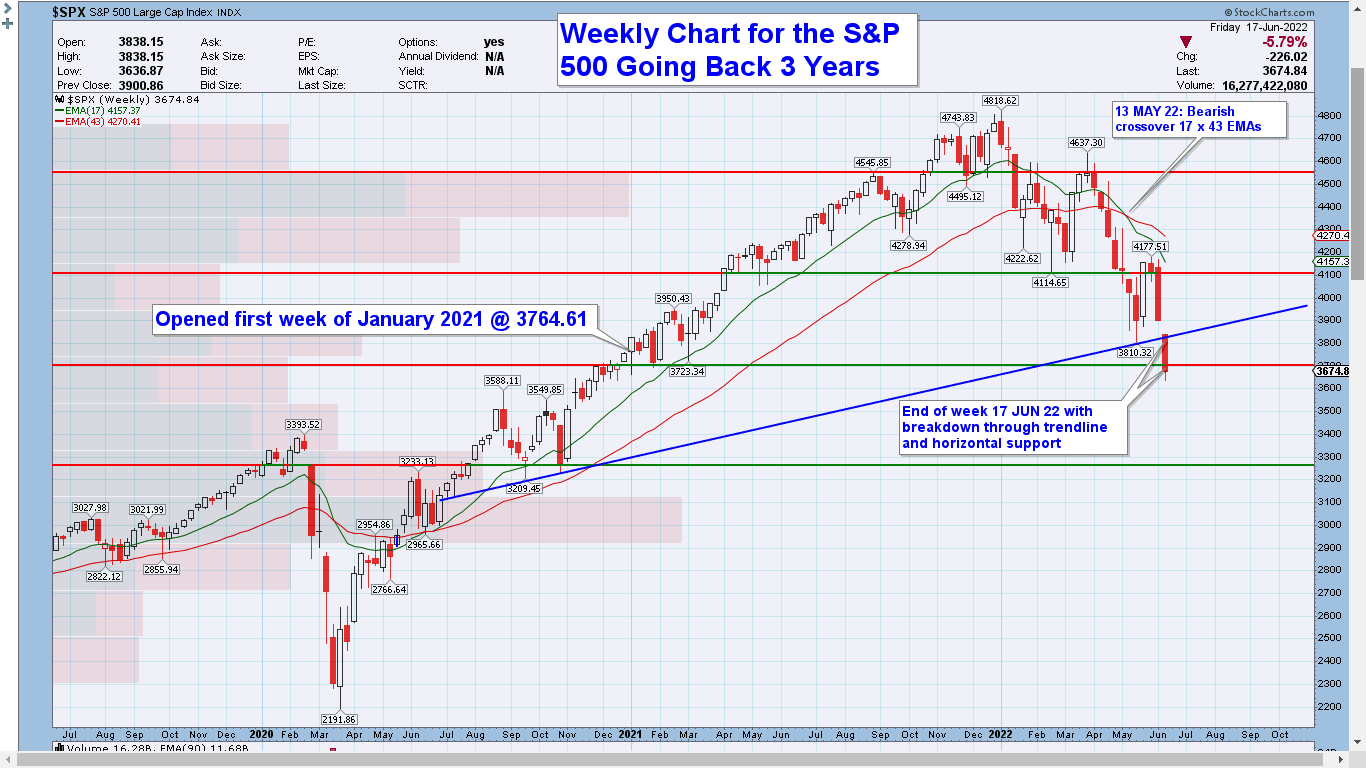

4. Weekly chart for $SPX the S&P 500, end of week, 17 JUN 22

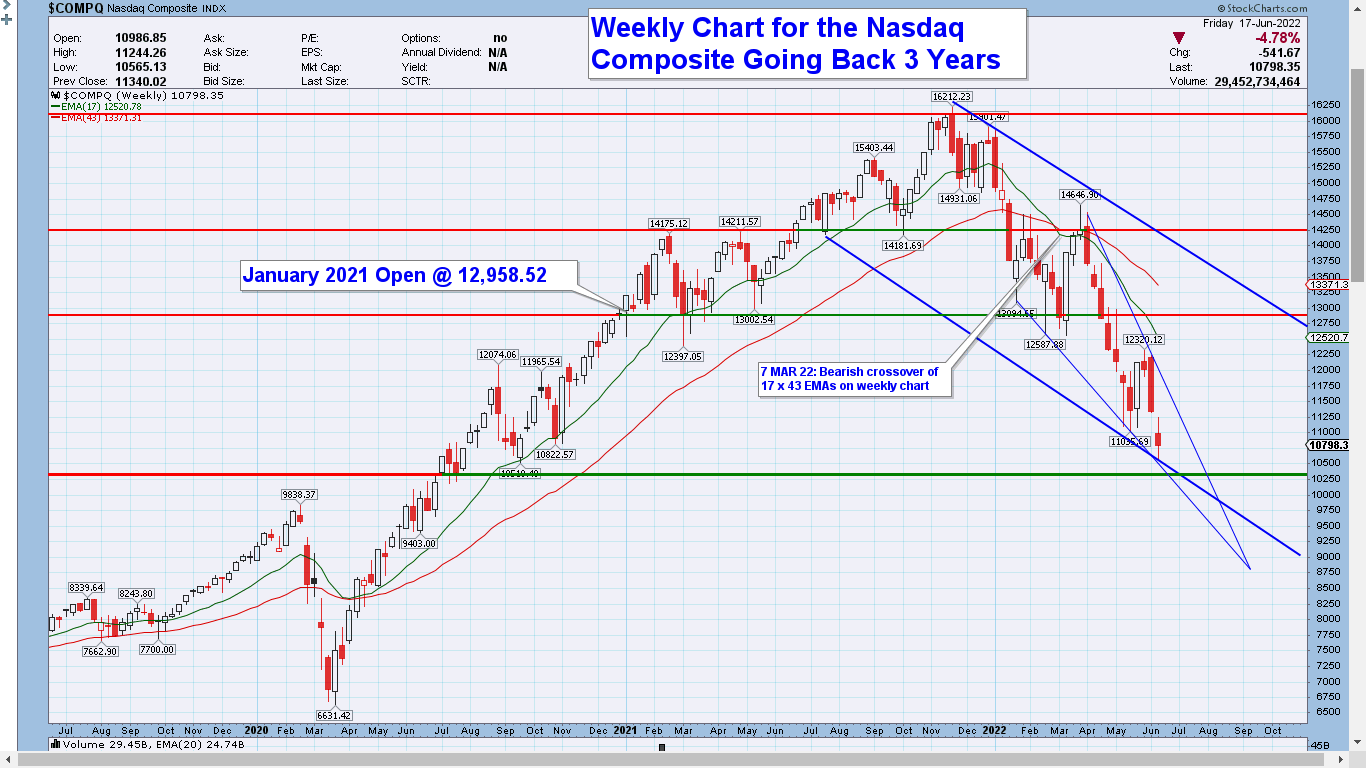

5. Weekly chart for $COMPQ the Nasdaq Composite, end of week, 17 JUN 22

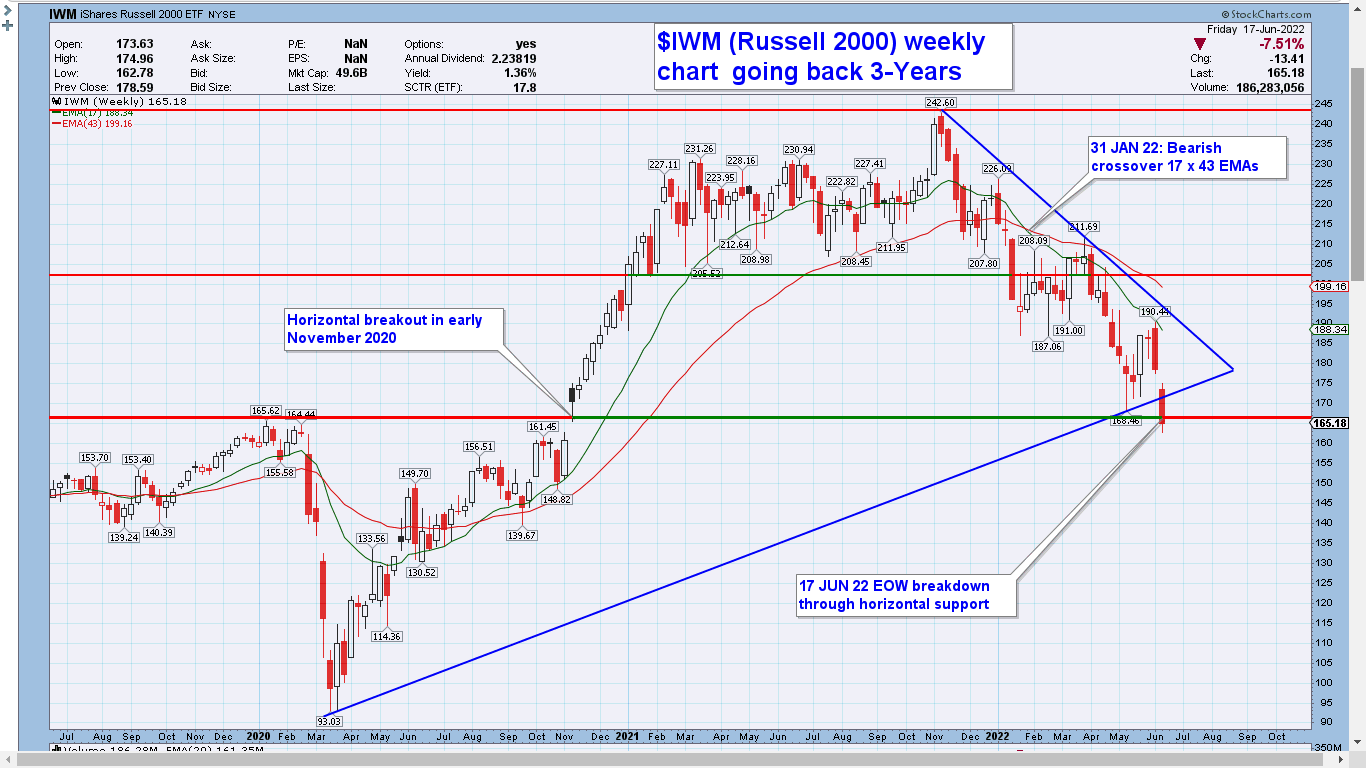

6. Weekly chart for $IWM the Russell 2000 ETF, end of week, 17 JUN 22

7. Weekly chart for $KBE Banking ETF, end of week, 17 JUN 22

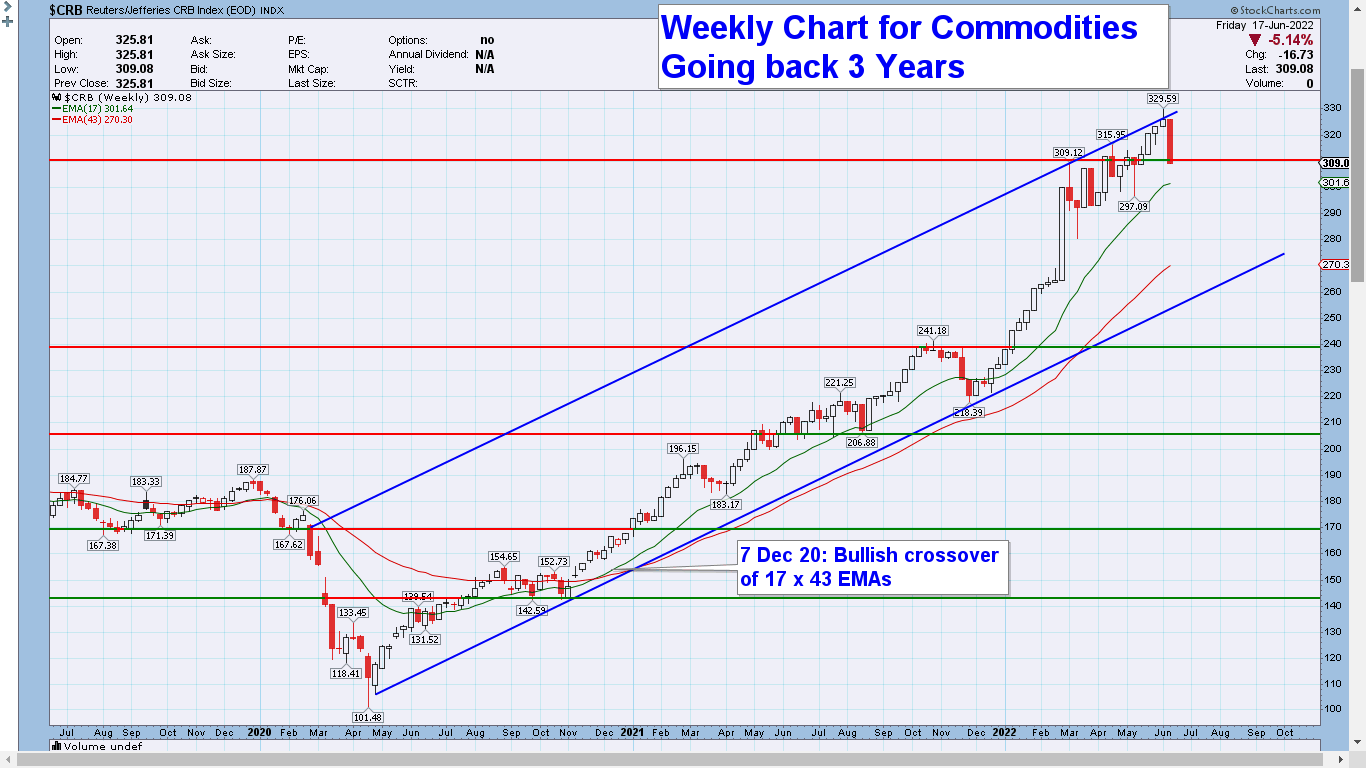

8. Weekly chart for $CRB Commodities Index, end of week, 17 JUN 22

9. Weekly chart for $BDI Baltic Dry Index, end of week, 17 JUN 22

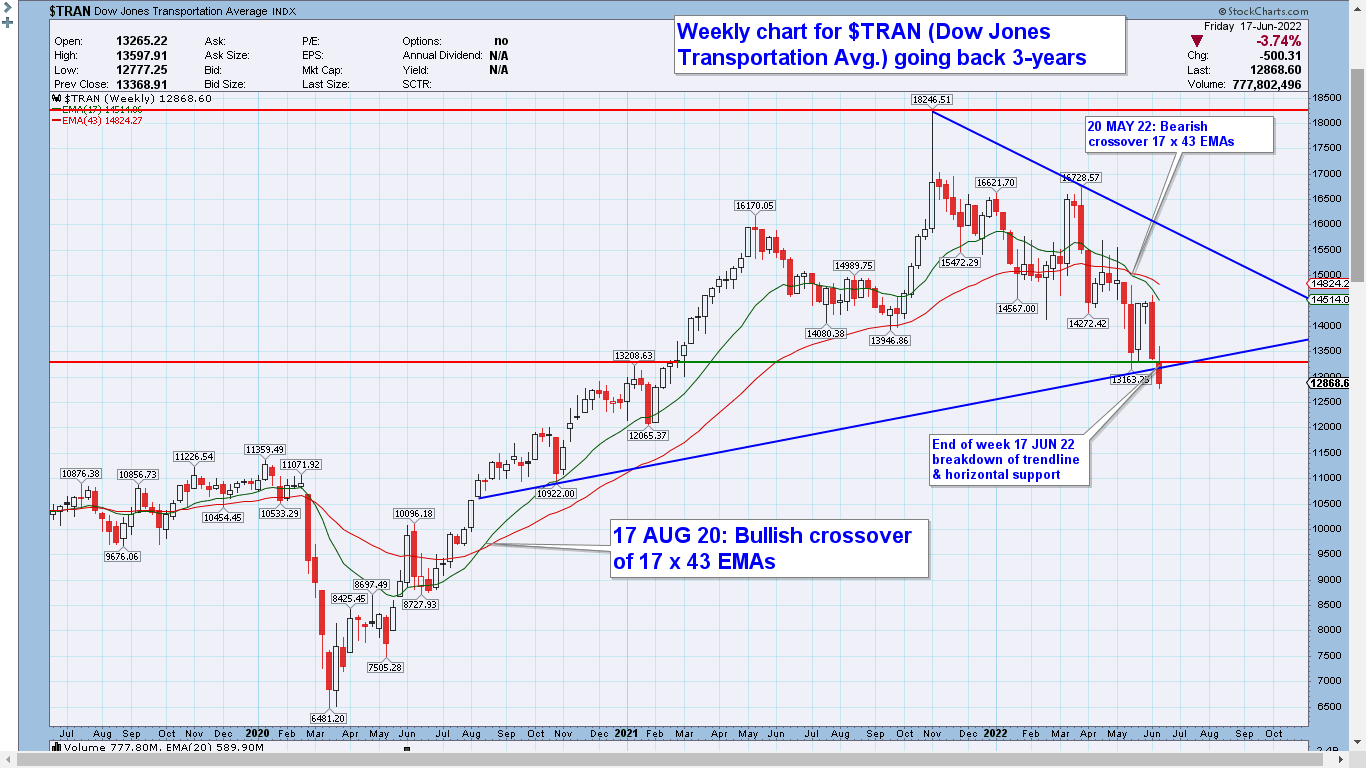

10. Weekly chart for $TRAN Dow Jones Transportation Index, end of week, 17 JUNE 22

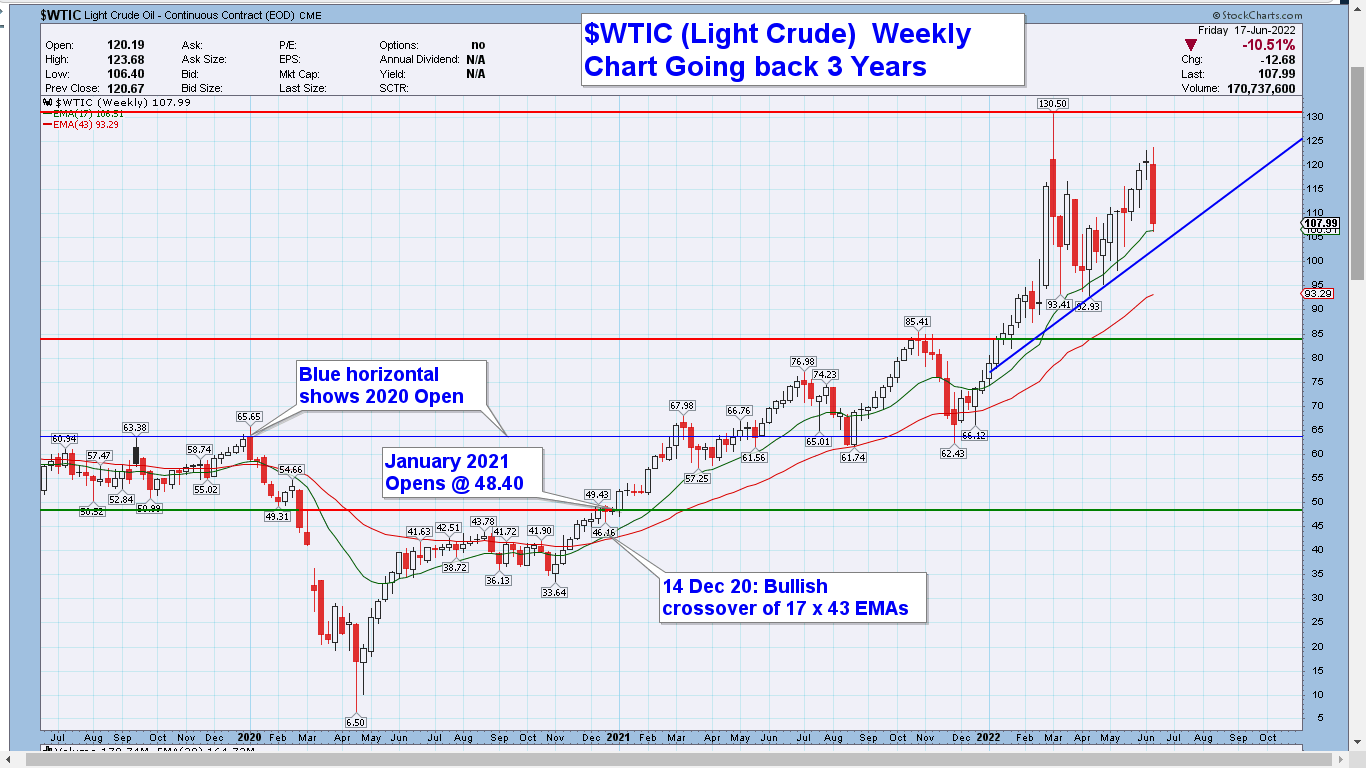

11. Weekly chart for $WTIC Light Crude, end of week, 17 JUN 22

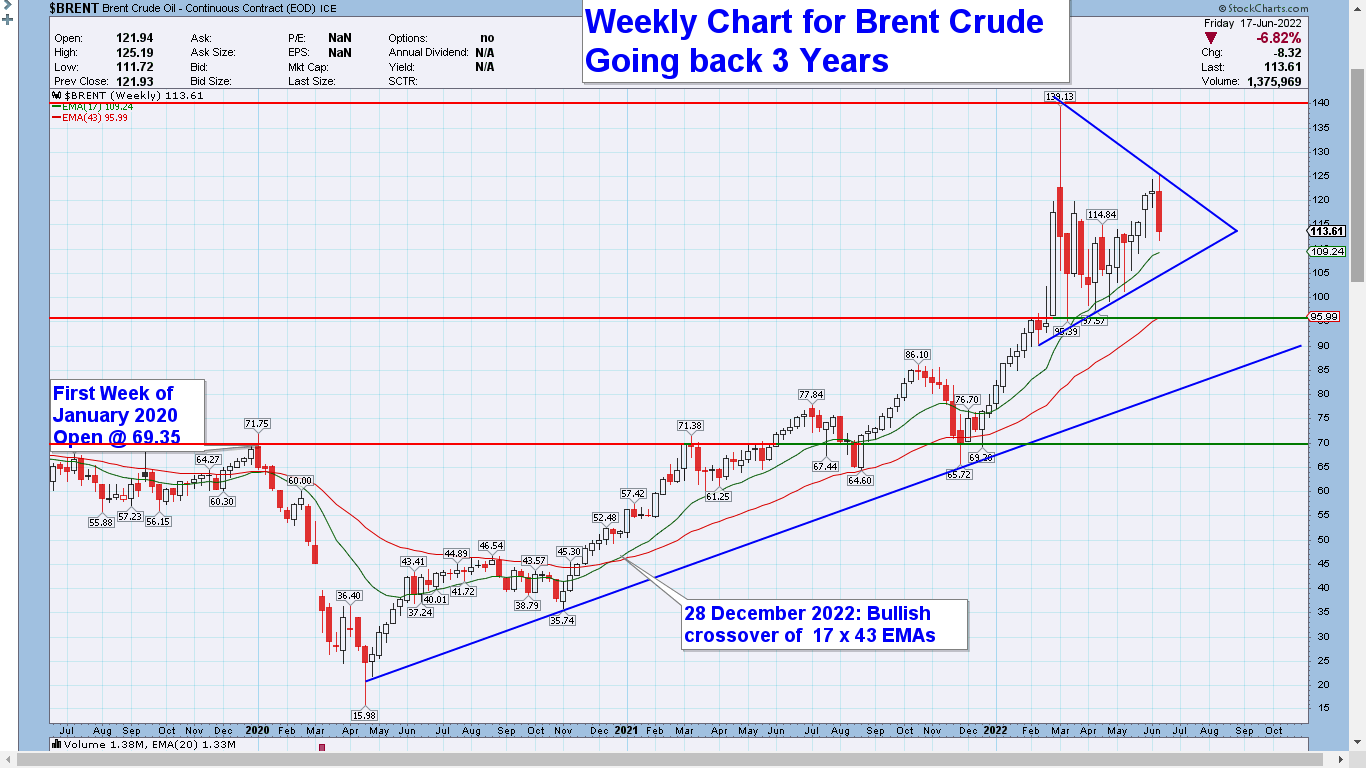

12. Weekly chart for $BRENT Brent Crude, end of week, 17 JUN 22

13. Weekly chart for $GASO Gasoline, end of week, 17 JUN 22

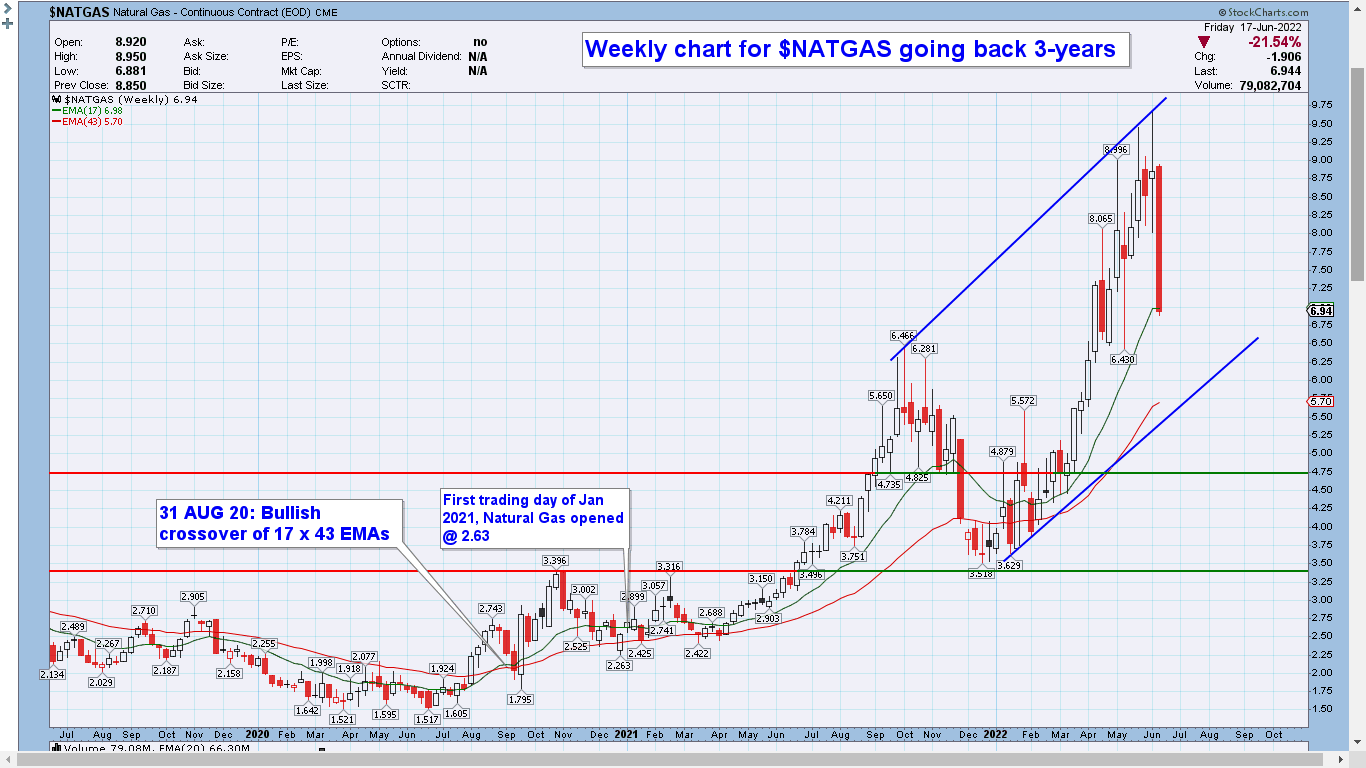

14. Weekly chart for $NATGAS Natural Gas, end of week, 17 JUN 22

15. Weekly chart for $ICLN Global Clean Energy ETF, 17 JUN 22

16. Weekly chart for $LIT Lithium Fund, end of week, 17 JUN 22

17. Weekly chart for $REMX Rare Earth Strategic Metals ETF, end of week, 17 JUN 22

18. Weekly chart for $HYDR Global Hydrogen ETF, end of week, 17 JUN 22

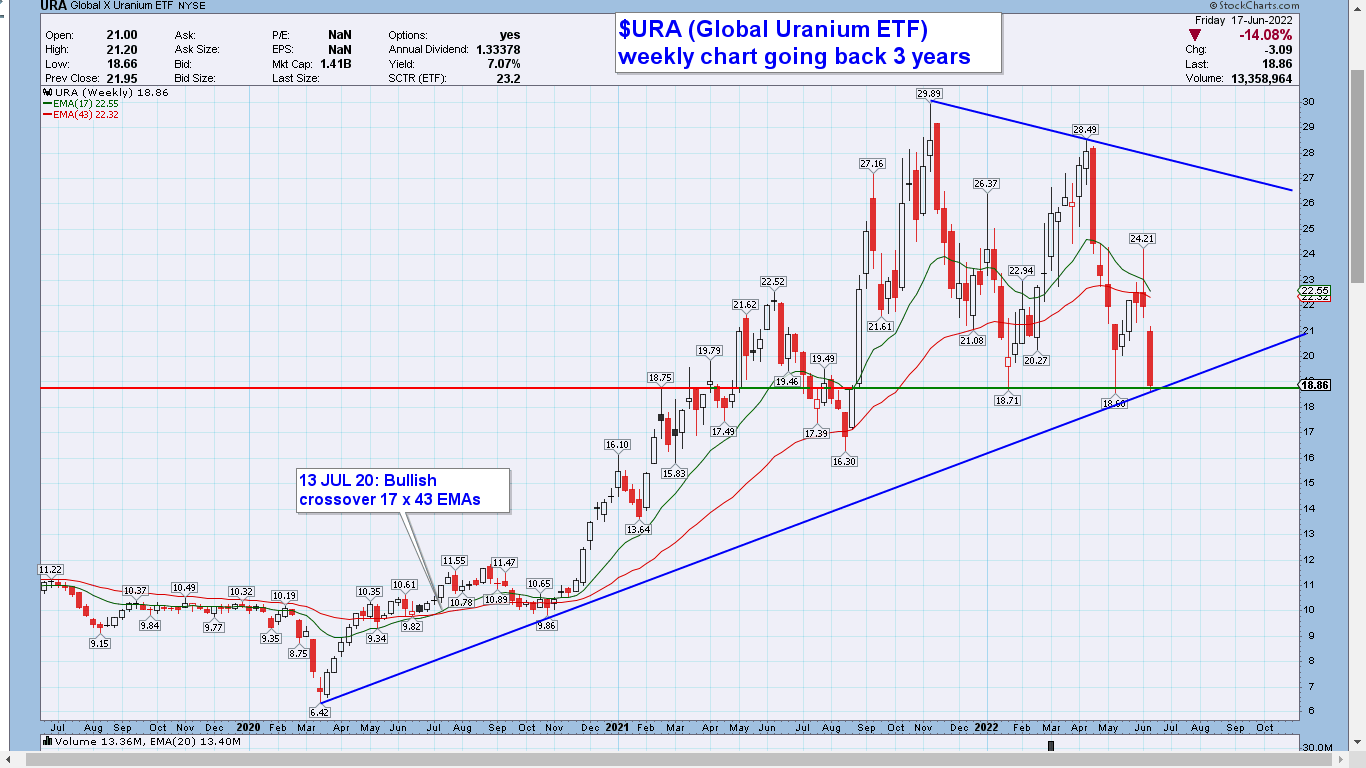

19. Weekly chart for $URA Uranium ETF, end of week, 17 JUN 22

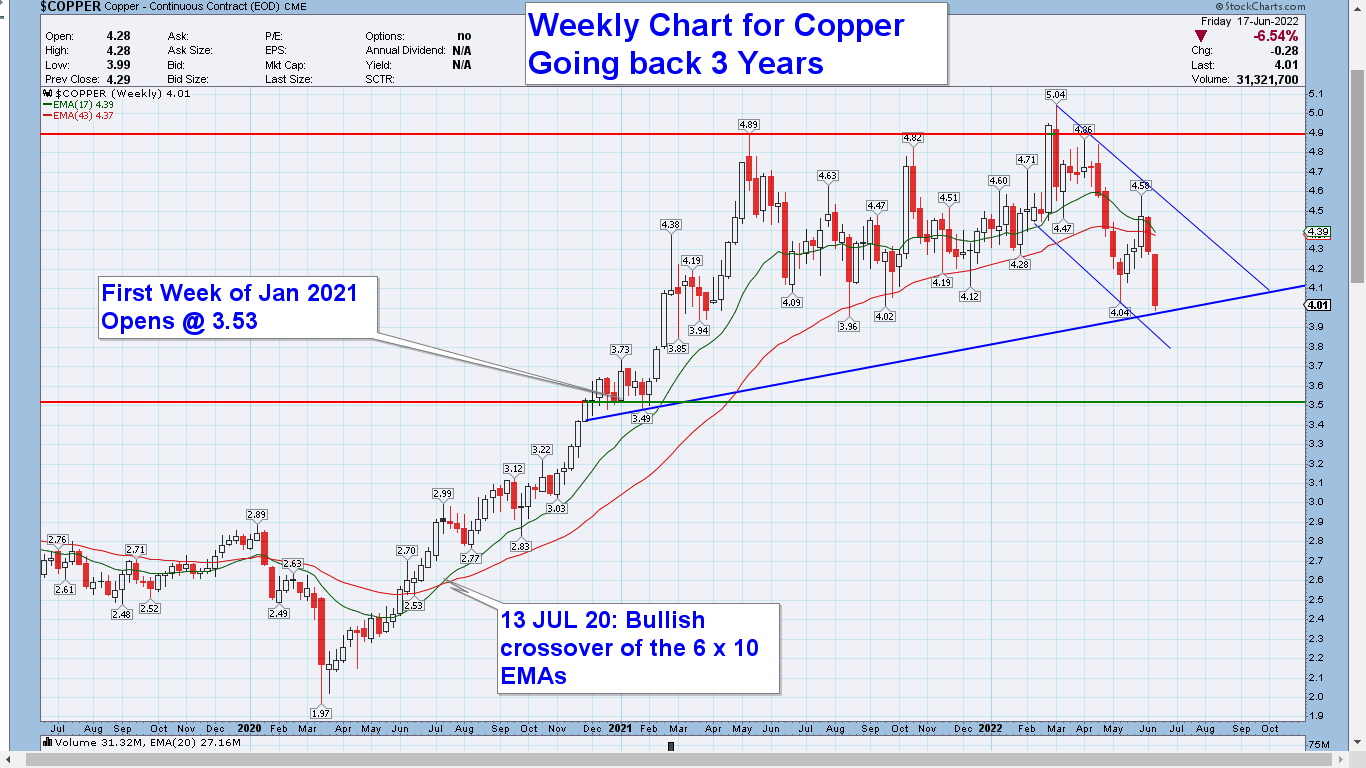

20. Weekly chart for $COPPER Copper, end of week, 17 JUN 22

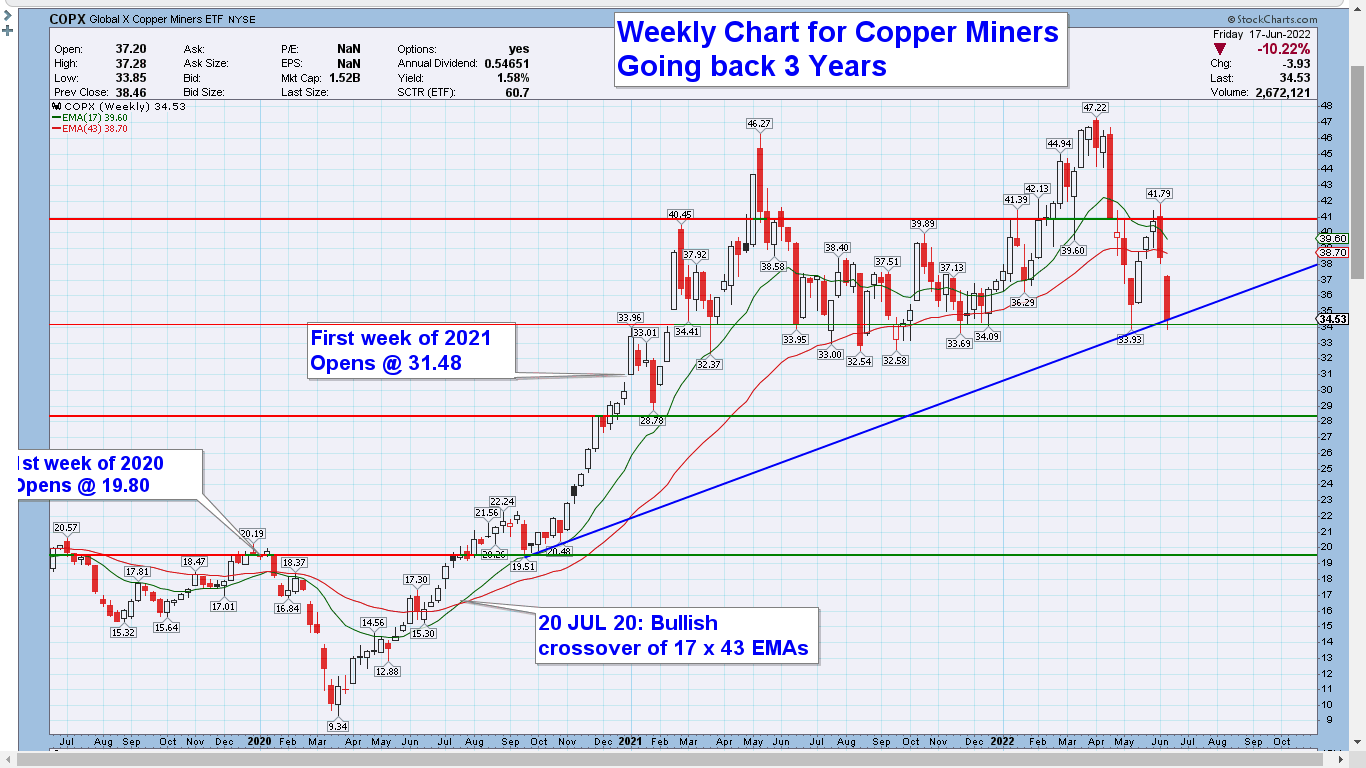

21. Weekly chart for $COPX Global Copper Miners, end of week, 17 JUN 22

22. Weekly chart for $SLX Steel ETF, end of week, 17 JUN 22

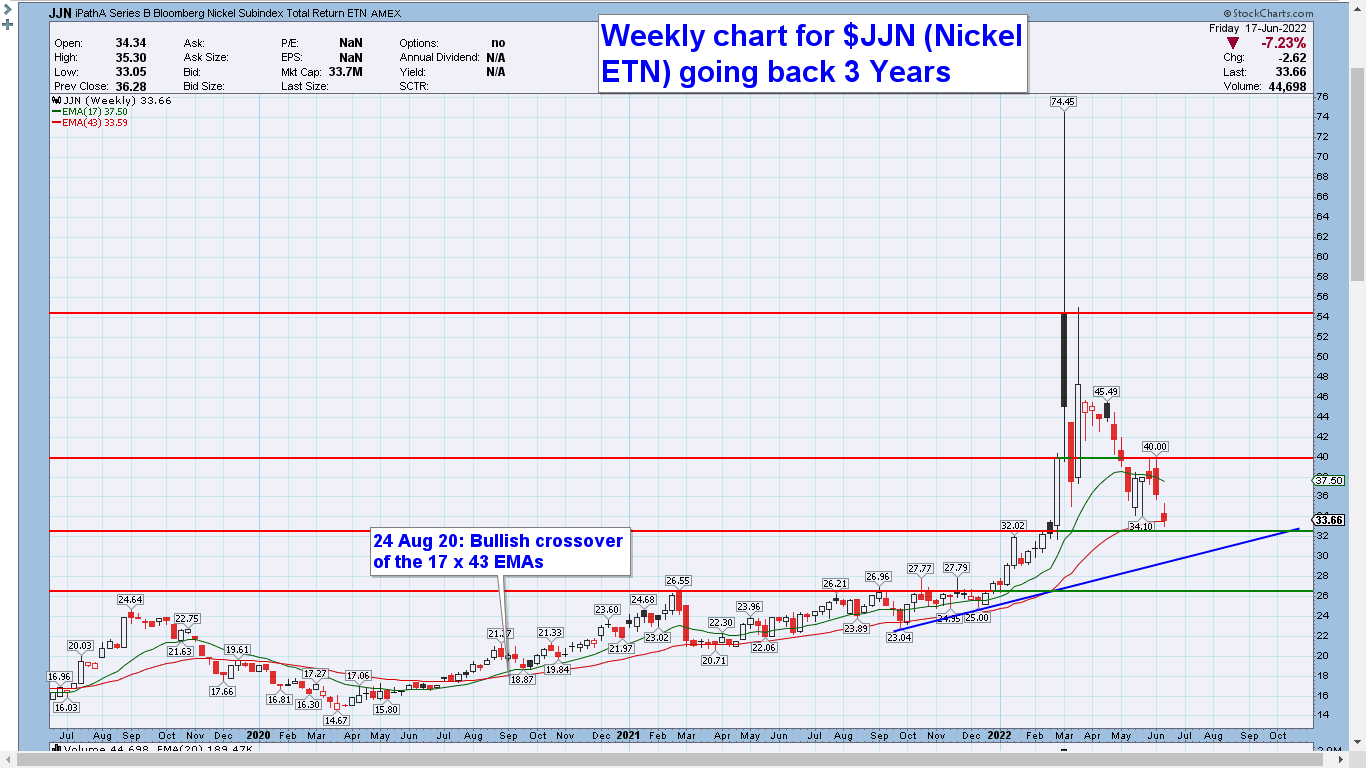

23. Weekly chart for $JJN Nickel ETN, end of week, 17 JUN 22

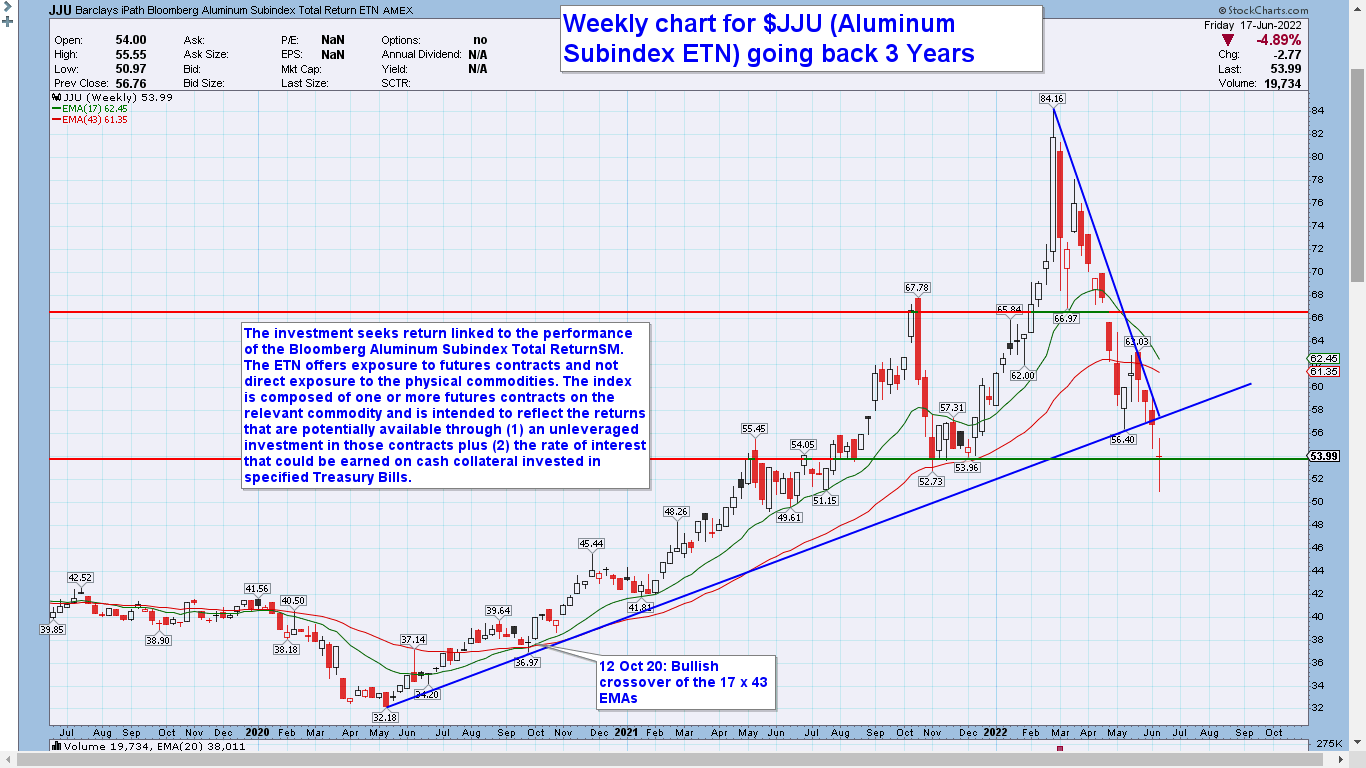

24. Weekly chart for $JJU Aluminum Subindex Total Return ETN, end of week, 17 JUN 22

25. Weekly chart for $JETS, end of week, 17 JUN 22

26. Weekly chart for $BOTZ the Global Robotics & Artificial Intelligence Thematic ETF, end of week, 17 JUN 22

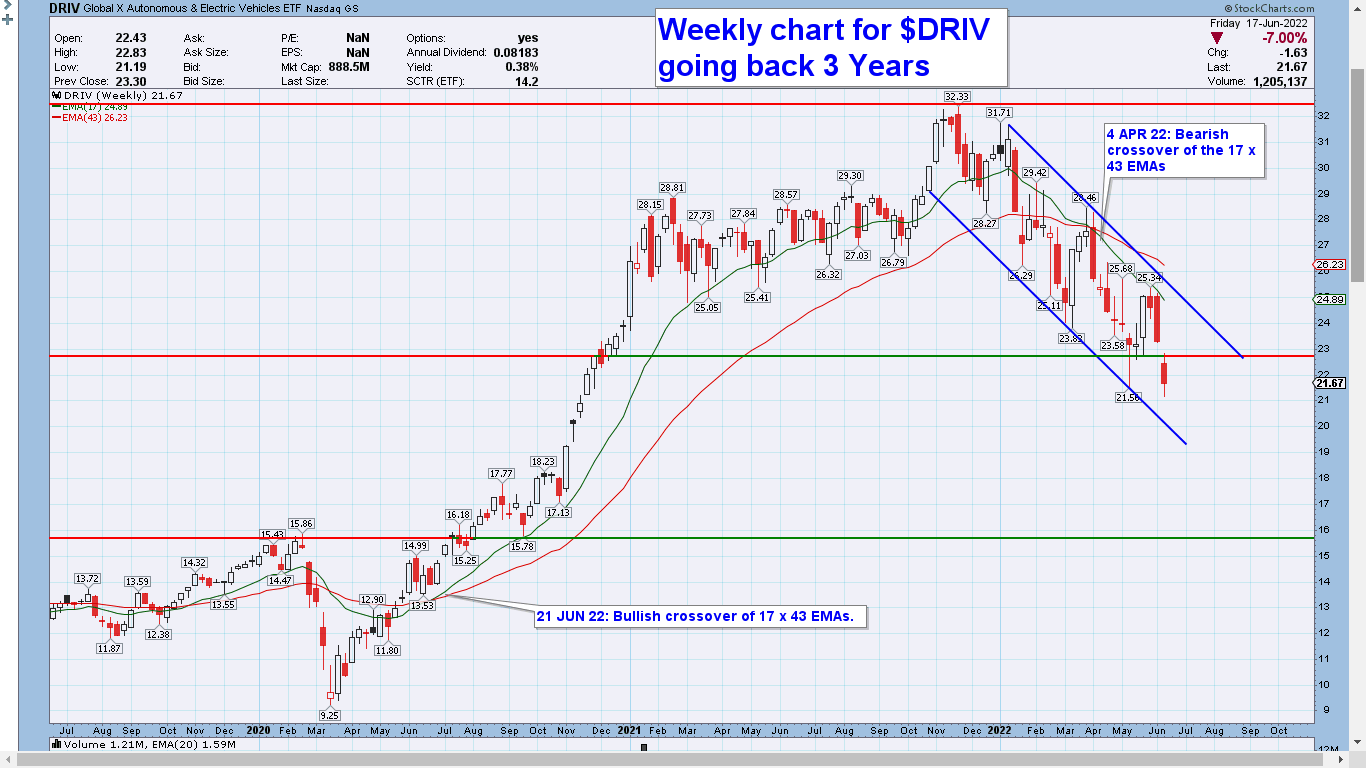

27. Weekly chart for $DRIV (Global Autonomous & EV ETF, end of week, 17 JUN 22

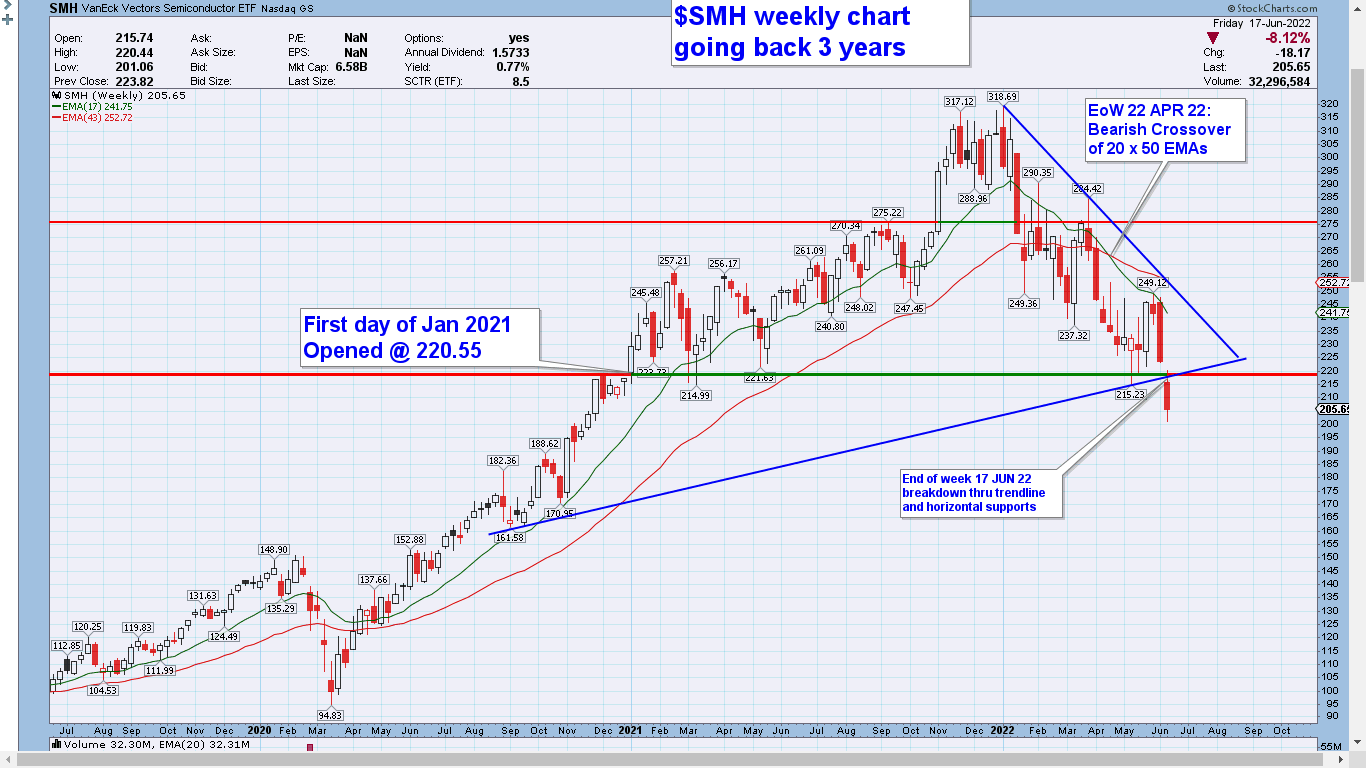

28. Weekly chart for $SMH Semiconductor ETF end of week, 17 JUN 22

29. Weekly chart for $LUMBER, end of week, 17 JUN 22

30. Weekly charts for $PAVE the Infrastructure Development Fund, end of week, 17 JUN 22

31. Weekly chart for $XBI Biotech Sector, end of week, 17 JUN 22

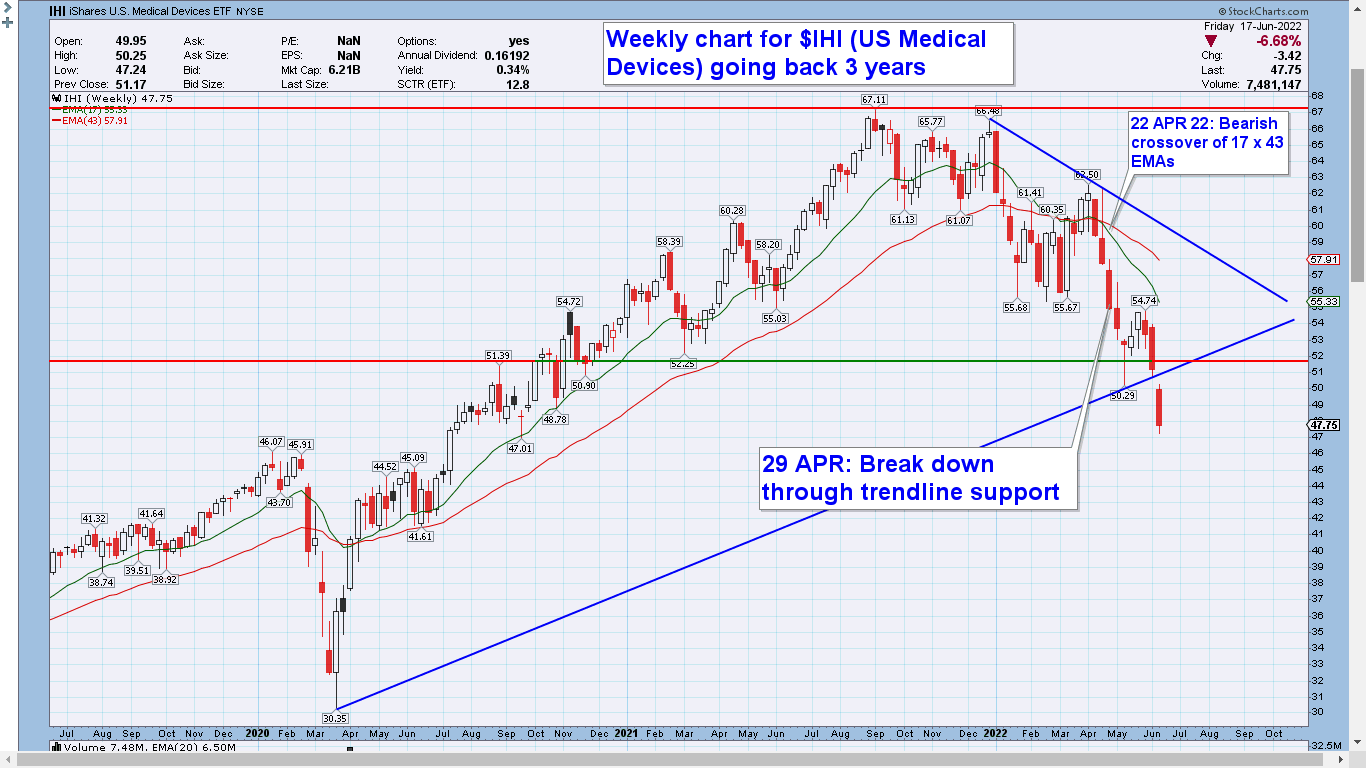

32. Weekly chart for $IHI U.S. Medical Devices ETF, end of week, 17 JUN 22

33. Weekly chart for $DBA Agriculture Fund, end of week, 17 JUN 22

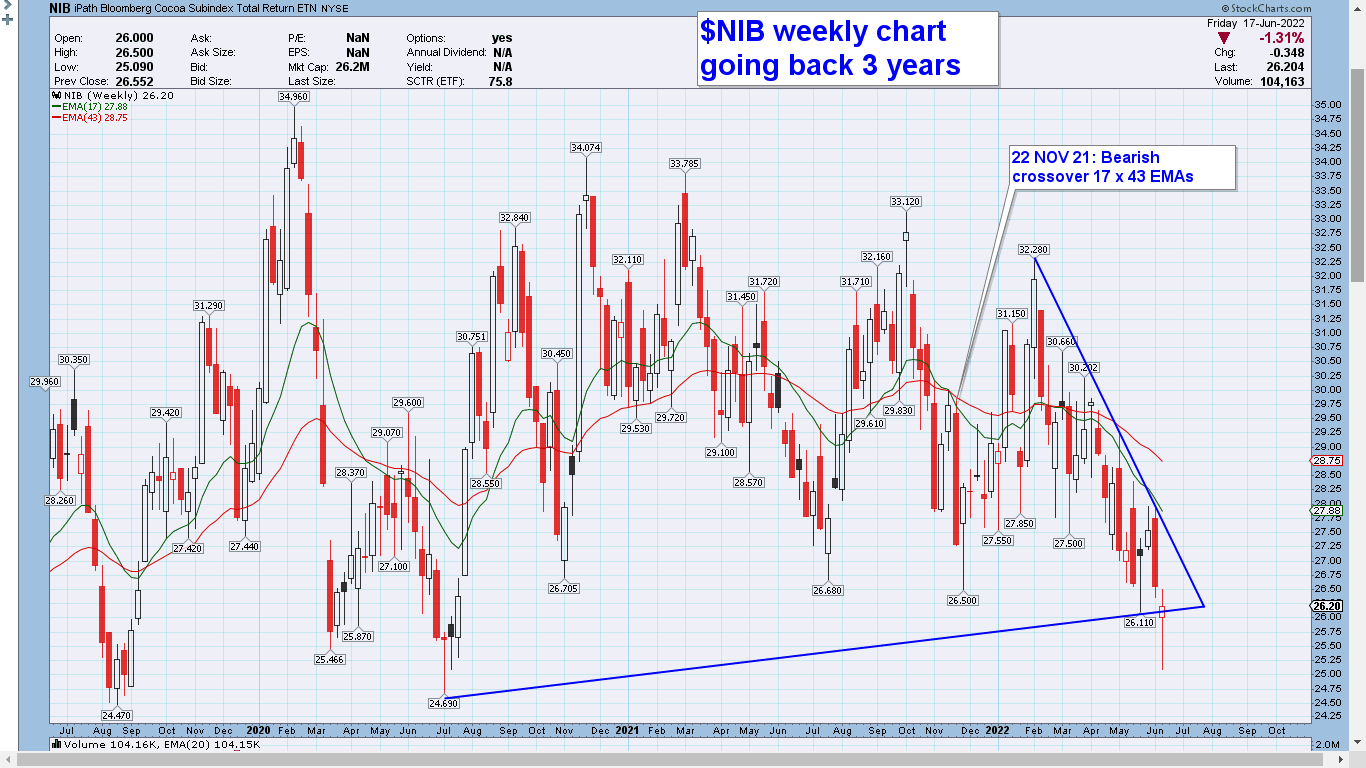

34. Weekly chart for $NIB Cocoa ETN, end of week, 17 JUN 22

35. Weekly chart for $WEAT (Tecurium Wheat Fund), end of week, 17 JUN 22

36. Weekly chart for $CORN (Teucrium Corn Fund), end of week, 17 JUN 22

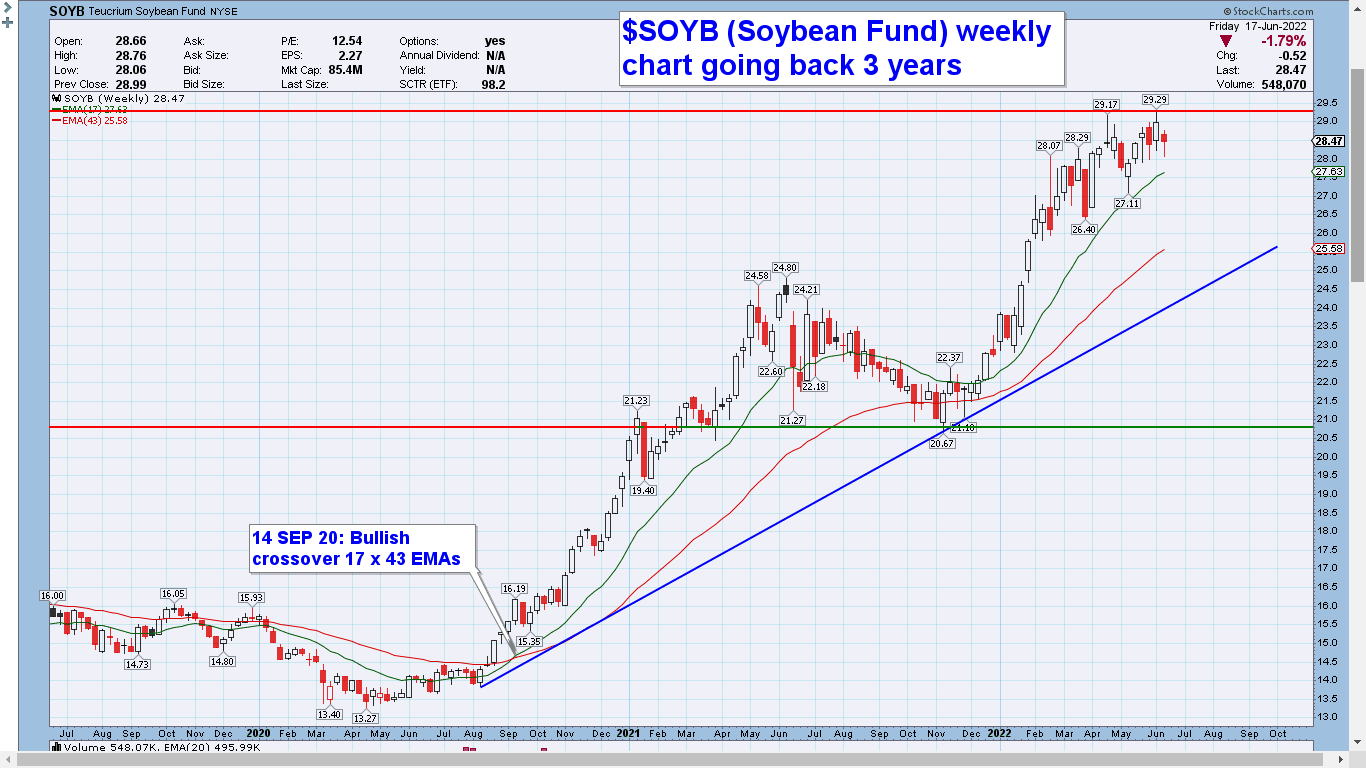

37. Weekly chart for $SOYB (Teucrium Soybean Fund) end of week, 17 JUN 22

38. Weekly chart for $MJ Marijuana ETF, end of week, 17 JUN 22

39. Weekly chart for $GOLD, end of week 17 JUN 22

40. Weekly chart for $GDX Gold Miners, end of week, 17 JUN 22

41. Weekly chart for $Silver Silver, end of week, 17 JUN 22

42. Weekly chart for $SIL Silver Miners, end of week, 17 JUN 22

My colleague Collin Martin points out cracks showing in the high-yield bond market. High-yield credit default swaps are flashing more warning signs than cash bonds. pic.twitter.com/FZ8LvYTBPw

— Kathy Jones (@KathyJones) June 16, 2022

Cracks in US High Yield bond market have started to emerge

Credit Spreads on junk bonds have topped 500 bps (first time since Nov'20)

Firms with weak balance sheets, poor credit ratings etc. are about to face a very hard time raising money

Expect bankruptcies if this continues pic.twitter.com/7PMcalmdTx

— Tar ⚡ (@itsTarH) June 17, 2022

It's a fast-moving regime change in bond markets. The total amount of outstanding negative-yielding debt has shrunk to the least since 2014, at $1.65 trillion down from as much as $18.4 trillion not long ago. pic.twitter.com/iI6pgTytEb

— Lisa Abramowicz (@lisaabramowicz1) June 16, 2022

ECB wants to intervene in bond markets (buy Italy debt and sell German bunds) to stop fragmentation, BBG reports. But this also eliminates market forces, which are an important disciplining tool. And who actually determines which risk premiums are justified for which debt ratios? pic.twitter.com/fw89t6PGye

— Holger Zschaepitz (@Schuldensuehner) June 16, 2022

The correlation between stocks and bonds over the last two years is the highest we've seen since 1995-1997. pic.twitter.com/z2dLrsnaEh

— Charlie Bilello (@charliebilello) June 14, 2022